Business recovery services

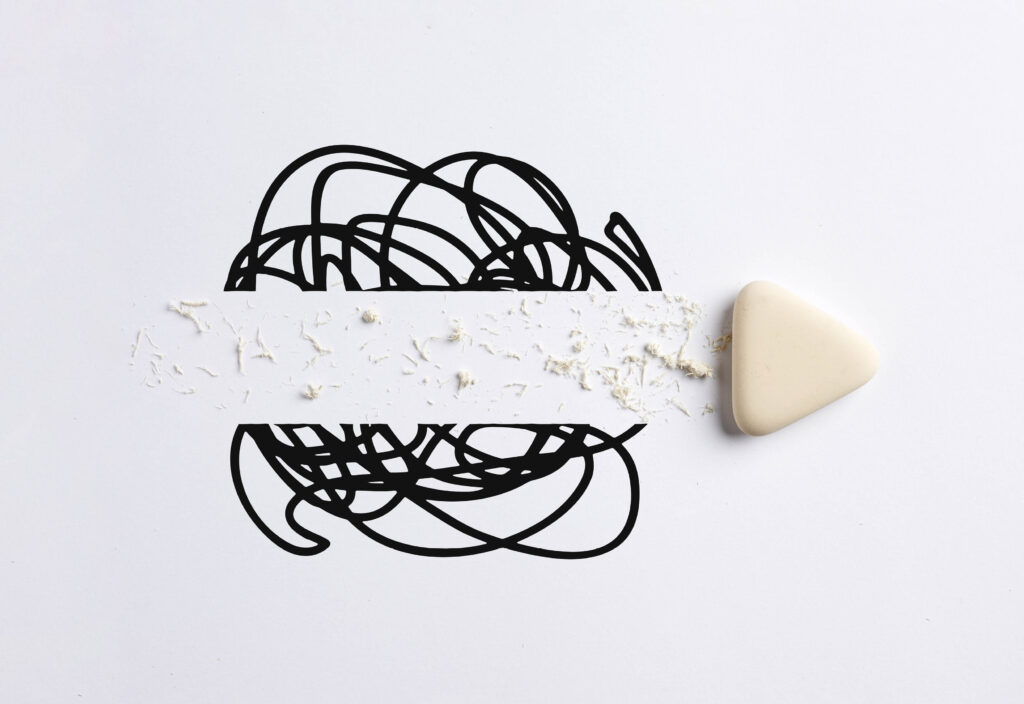

Is your business showing signs of financial distress?

It can be difficult to admit that your business is in trouble. In fact, it’s tempting to simply keep on going as you always have, with the vain hope that if you ignore the situation, it might all go away. But at some point, you’ll come to the end of the road.

Our business rescue specialists can help get you back on track.

Perhaps you’ve just been hit with an unexpected, crippling tax bill, or maybe you’re suffering with regular cash flow problems. It could be that a sudden change in the market has left you blindsided and unsure how to go on. It’s nothing to be ashamed of – it could literally happen to anyone. After all, the Covid-19 pandemic turned the economy upside-down overnight, resulting in conditions that would have challenged even the most experienced of Finance Directors.

It doesn’t have to be the end

It’s always frightening to see your business in trouble. You have poured huge amounts of time, money and effort into it over the years; the idea of losing it all is a horrible thought. But it doesn’t have to be the death knell for your business if your fundamental business plan is sound. And you don’t have to do it alone.

So, let’s put together a corporate turnaround strategy. With careful financial management and using all the business rescue strategies in our considerable arsenal, we’ll do our utmost to get you back on firm financial footing.

The result?

No more sleepless nights, and a future you can start trusting again.

Is my business in real financial trouble?

It’s a question we’re often asked by the business owners we work with. How can you tell the difference between a temporary blip and serious financial difficulties?

Fortunately, there are some early warning signs you can watch out for to help you understand when you need to really start taking things seriously. If you’re experiencing just one of them, there may not be a cause for concern. But if several of these issues are currently impacting your business, you and your team likely need urgent help before things get any worse.

For example:

- Your cash flow is unstable and holding your business back, and you never seem to have accurate management accounts that tell you what you actually have available

- You need credit but are being refused by lenders

- Your profits are on a one-way downward spiral

- And your stress levels are mounting ever higher

- Your creditors are circling but you can’t pay them

- You don’t have enough working capital

- You are borrowing more and more, but it’s never enough.

Why is my business in financial difficulty?

Before we can help turn your business around, it’s important to understand exactly what went wrong in the first place so that we can attempt to resolve the issues that led you here. There may be several factors that have compounded to produce your unique situation. Over the years, we have learnt that no two business stories are ever the same.

What we do know, however, is that the reasons for business failure can loosely be grouped into internal and external factors.

Internal factors have to do with the inner workings of your business. Your financial procedures and controls might not be robust enough, allowing problems and mistakes to proliferate. The people looking after your business’s finances may not have the skills and tools they need.

Or you might not be getting the financial information you need to make good decisions for your business. Over time, poor financial management can bring a company to its knees.

External factors are not within your company’s control – although a business with good financial management procedures in place will automatically be in a better position to deal with these external stressors. Unforeseen events such as the coronavirus pandemic or an economic recession can deal a significant blow to your business’s finances. You might have a new rival in the marketplace with whom you’re struggling to compete. Many businesses also experience difficulties with late payment, which has a knock-on impact on their own ability to pay creditors and suppliers.

Whatever is ailing your business, we can help you get to the bottom of it.

The benefits of early intervention

If your business is failing financially, early intervention is critical if you are to survive. The later you initiate company rescue proceedings, the more likely it is that your business will fall into insolvency. Yes, it really is that serious.

The trouble is that rescuing a failing company takes specialist skills and experience that you probably don’t have. It’s a unique situation that even your accountant might not have experienced before. We, on the other hand, have experienced it – many times over, whilst assisting companies of all shapes and sizes. We have helped turn around businesses on the brink of collapse, and we can help you too.

Depending on your business’s situation, our team may be able to:

- Stabilise your cash flow

- Return you to profitability

- Fix the underlying problems that caused your financial distress to ensure they never recur

- Help you make better financial decisions

- Support you throughout the process and reduce your stress levels

- Reduce the pressure on your team

- Provide a valuable outside perspective and the expertise of a full team of financial specialists

- Ensure you are compliant with your responsibilities as company director.

Additional services

Company turnaround

When your business is in distress, it can be incredibly stressful with far-reaching impacts. In this video, the Insight team discuss the consequences of financial distress for everyone involved in the business, and how we have supported businesses just like yours through the recovery process and on to success.

Testimonials

Let’s chat

If our services sound like the right fit for your business, let’s chat. We’ll find out exactly where your business is at, where you’d like it to be, and how we can help you bridge the gap.

You might also be interest in...

We’re seeing something worrying in the market. Are you?

- November 26, 2025

Your dividend tax just went up (did you notice?)

- December 3, 2025

The E-Myth mistake even brilliant business owners make

- November 19, 2025