Over the past few weeks I’ve become a lot more active on LinkedIn.

I’ve noticed an enormous improvement in the quality of the posts since I was last heavily involved on the platform, a few years ago.

There’s still a bit of boring, salesy material. But there are also a lot of people sharing knowledge, posting outstanding business advice, and writing authentically about their business experiences and dilemmas. I’m actually enjoying it this time around.

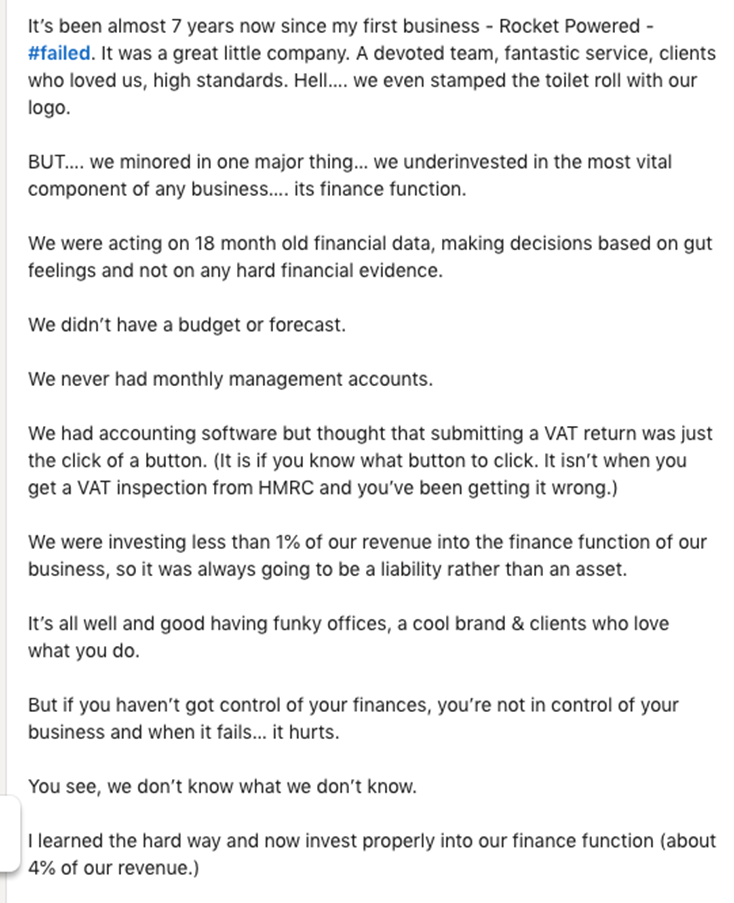

A few weeks ago, I was tagged in a post written by a (now) successful businessman, whose first company collapsed even though it had a great product and loyal customers.

I’ll let him tell you the story himself….

Read that line again: “If you haven’t got control of your finances, you’re not in control of your business.”

I couldn’t have put it better myself.

The thing is, when I talk about how dangerous it is to neglect your financial management, I know some business owners think I’m exaggerating.

When your company is growing nicely and when your team and your clients love what you’re doing, it’s hard to accept that there’s an underlying weakness in your business…

…One that could potentially finish you off.

But it can. I’ve seen it happen again and again.

When you can’t tell how much money is going to be in your business account in 3 months’ time and whether you can afford your expansion plans…

When you make financial decisions in the dark, without referencing real numbers…

When you don’t really understand which parts of your business are profitable and which are not…

When you’re not keeping proper financial records and have no idea whether your accounts are accurate…

You’re vulnerable – very vulnerable…

And you can wake up one day to discover that you’re in serious financial trouble.

Because truth is, if you never really understood your financial position, appearances can be deceiving. But many business owners don’t find this out until out too late.

And I’ll tell you what… When your company’s finances are poorly run, it’s also really hard to imagine how much easier it is to grow with real financial insights at your fingertips.

You become so much more confident and successful as a business leader, when you no longer have to make decisions based on “gut feeling,” but taking data into account.

And your entire business feels calmer when your finance function runs like clockwork. You no longer have to spend your time dealing with financial fires, and can plan our business’s growth properly.

It’s transformative.

If that’s the kind of change you need to see, it’s time to get in touch with me.

Our Outsourced Finance Department is all about giving you world-class financial management – so that you can make the very best financial decisions for your company, maximise your profitability and grow to £5 million or £10 million (definitely not fail!).

And by the way, I don’t agree that you should be investing exactly 4% of your turnover into your finance function, as this business owner recommends. The amount you need to invest depends on how complex your business is, amongst other factors.

The Outsourced Finance Department charges a flat monthly fee, which is specifically designed to allow businesses to get the kind of financial management that corporates take for granted, even when they’re smaller.

To find out more, hit ‘reply’ to this email or call us today on 01279 647 447. I’ll get right back to you.

And take it from a business owner who’s learned from bitter experience: “If you haven’t got control of your finances, you’re not in control of your business.”

Warmly,

Garry